July employment disappoints at 73,000 jobs, sending markets into panic. New U.S. reciprocal tariffs hit 60+ countries, striking Canada at 35%. Fed rate cut probability spikes to 80%. International trade confronts historic realignment.

Markets Plummet into Freefall on Twin Economic Shocks

Wall Street experienced its worst single-day drop in three months. The Dow Jones Industrial Average fell 531 points (1.2%) at 1 PM ET. The S&P 500 fell 93 points (1.6%), while the Nasdaq Composite dropped 451 points (2.1%). This triple-index plummet is a sign of investor fear of worsening labor statistics and severe new U.S. trade restrictions.

July Hiring Slowdown Outpaces Projections

Firms hired only 73,000 jobs last month – 47% less than economists expected. The Labor Department added to worry by reducing May-June payrolls by 258,000 jobs. Three key implications arise:

- Labor market downturn: Employment growth has reduced by half since Q1 2023.

- Mismatch in inflation: Wage pressures remain in place despite weakening employment.

- Consumer spending risk: Disposable income is under compression.

“Stocks responded negatively to back-to-back data shocks,” eToro analyst Brett Kenwell observed. “Inflation rises, job growth falters, and tariff tensions continue unresolved with cosmetic improvements.”

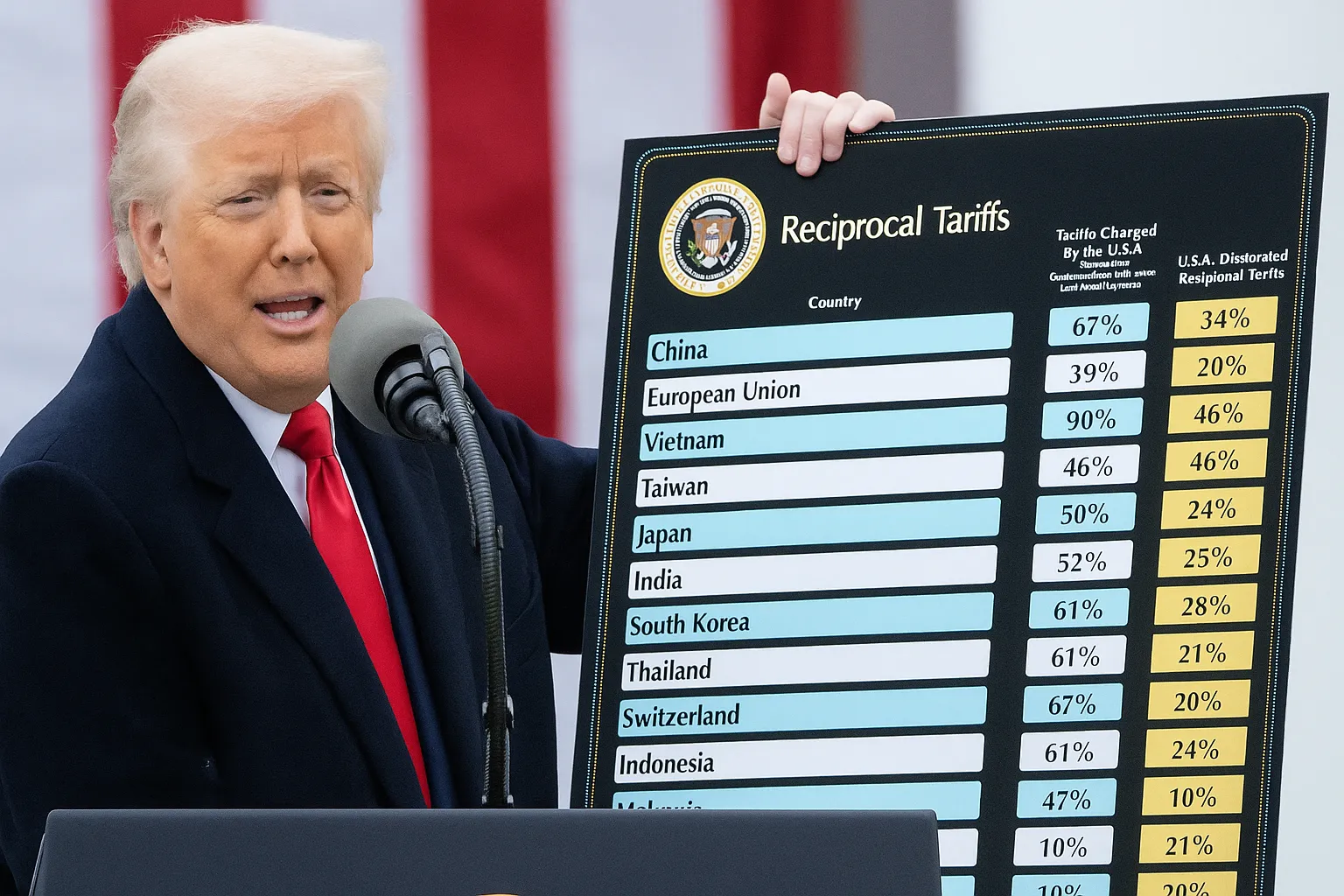

Reciprocal Tariffs Redraw Global Trade (Effective August 1)

The White House activated record tariffs against 69 trading partners. The policy is the strongest U.S. trade limitation since the Smoot-Hawley Act of 1930.

Sector-Specific Carnage Emerges

Pharmaceuticals dropped 4.3% after President Trump called for 17 big drugmakers to cut prices. Tech diverged dramatically: Amazon plummeted 7% on soft cloud revenue, while Apple rose 1% on services expansion. Industrial products dropped 2.8% due to tariff exposure concerns.

Federal Reserve Shift Speeds Up

CME FedWatch pegs a 80% chance of September rate cuts – from 45% ahead of data. Fed Chairman Jerome Powell specifically put labor market health at the top of the priority list in last week’s policy statement:

“Employment metrics now control monetary policy. We can’t turn a blind eye to weakening payroll momentum.”

The Fed’s reference rate remains at 4.25%-4.5%, yet markets anticipate three 2024 reductions.

Global Domino Effect Speeds Up

- Asia: PMIs for manufacturing declined in Japan (48.1), South Korea (49.4), and ASEAN countries.

- Europe: Auto deliveries stalled at German ports. French wine exporters swallow 25% margin reductions.

- Currencies: Canadian dollar falls to 2-month low ($1.42/USD); DXY dollar index jumps to 106.8.

India-U.S. Trade Crisis Deepens

New 25% tariffs imposed on all Indian exports following continued Russian crude purchases. External Affairs Ministry spokesman Randhir Jaiswal justified India’s stance:

“Our energy relationship with Russia is time-tested. U.S.-India strategic partnership has braved larger tests.”

Critical Timeline:

- 2022: India emerges as largest purchaser of discounted Russian Urals crude

- April 2023: U.S. threatens “secondary sanctions“

- July 2024: Russian crude imports fall to zero (unconfirmed)

- August 2024: Tariffs go into full effect

Demographic Time Bomb Ticks Louder

U.S. population growth cut in half to 0.5% per year since 2023. Peterson Institute’s Jed Kolko cautions:

“Monthly payroll gains need to rise above 86,000 just to keep pace with labor force participation – a level now in jeopardy.”

Agricultural Innovation Defies Climate Challenges

Australian wheat production now tops 1980s levels by 15 million metric tons per year despite hotter, drier weather. The main innovations behind the paradox:

- Drought-resistant genetically modified seeds

- Satellite-guided precision irrigation

- No-till farming to lower soil erosion

This accounts for 7% of international wheat trade – sufficient to feed 350 million people every year.

Geopolitical Rebalance Spreads

Three new trade blocs challenge dollar supremacy:

- Eurozone-Mediterranean: Single tariff response to U.S. action

- ASEAN-Russia: Commodity-backed currency settlements

- Mercosur-China: Infrastructure-for-commodities transactions

TPW Advisory’s Jay Pelosky comments:

“Regional FX blocks could wipe out the dollar’s 70% reserve currency share by 2030.”

Legal Pressures Mount

Federal Appeals Court judges challenged the use of emergency powers to impose tariffs. Central arguments:

- Article I gives Congress sole trade power

- “National emergency” thresholds not met

- Revenue-raising contravenes original intent

A last-minute decision on September 30 would invalidate all new tariffs.

Corporate Profits Reflect Divergent Trends

Pre-Market Movers (Aug. 2):

- ExxonMobil: +3.2% (leverage of oil price)

- Modern: -5.7% (vaccine demand precipice)

- Colgate-Palmolive: -1.9% (input cost inflation)

- Dominion Energy: +2.4% (regulated utility safety)

U.S. stocks fell more than 500 points after the horrific July jobs report (73K jobs) and imposition of retaliatory tariffs on 69 countries. Canada is subject to 35% tariffs, causing worldwide supply chain unrest. The Federal Reserve now indicates 80% probability of September rate reductions as labor markets weaken. India is facing 25% tariffs on Russian oil imports, while Australia proves agricultural strength through innovation. Tariffs could be voided by October through legal challenges but global trade reshuffling speeds up.

Trump Trade Deal Shift: India’s Winner, Pakistan’s Loser in U.S. Strategy

In a sudden turnaround in global trade diplomacy, former US President Donald Trump has shifted his government’s trade attention towards India and away from Pakistan. The move is intended to enhance US trade relations with trustworthy partners, particularly in the Indo-Pacific region, and decrease reliance on countries that do not get along with America.

India Becomes a Strategic Trade Ally

During Trump’s reign, America started to consider India as a vital trade partner. The government valued India’s stable economy, democratic system, and increasing presence in the Asia-Pacific region. Trump consistently highlighted India’s role as a reliable trade partner. This led to talks and agreements to boost bilateral trade, particularly in areas like defense, technology, and agriculture.

Trump’s America First policy initially advocated for combating aggressive tariffs and lower imports, but India successfully established itself as an exception by leveraging diplomatic channels and strategic alliances. With Modi and Trump having a personal relationship, India was at the center of most of the U.S.’s regional economic aspirations.

Pakistan Receives Diplomatic Cold Shoulder

Conversely, Pakistan was left out in Trump’s trade policy. The United States’ administration increasingly looked at Pakistan with distrust, especially regarding its relationships with extremist forces and erratic cooperation on security issues. Consequently, trade benefits and concessions enjoyed by Pakistan earlier were either minimized or completely withdrawn.

Following the sources, Washington started questioning Pakistan’s global alignments, particularly with China and some Middle Eastern actors. Numerous American businesses suspended or curtailed activities in Pakistan due to security fears and political turmoil. Washington also ousted Pakistan from a host of preferred trade lists, impacting its exports to America.

Russia and BRICS in the Background

Trump’s changing emphasis was not confined to South Asia. His government also adopted a cautious approach towards Russia and the BRICS bloc (Brazil, Russia, India, China, South Africa). Trump sought to balance relations while questioning the trustworthiness of such alliances, frequently accusing them of promoting anti-U.S. interests throughout the world.

This change in tone affected trade and diplomatic strategies with quite a number of BRICS nations. India, however, continued to remain an exception, enjoying its privileged status.

The Bigger Picture

This shift towards India and away from Pakistan wasn’t merely economic — it was part of a larger geopolitical reset. With China’s rising dominance and Russia’s aggressive foreign policy, the U.S. required a trusted ally in Asia. India, with its massive consumer market, military potential, and common democratic values, was the perfect fit.

At the same time, Pakistan’s ongoing internal instability, shaky economy, and diplomatic blunders led Washington to reconsider its long-standing strategic patience with the country.

Trump Threatened a BRICS country by Tariff

The Trump administration represented a watershed moment in American trade and diplomatic policy in South Asia. India was increasingly viewed as a reliable economic ally, while Pakistan was relegated to the periphery. It is probable that this shift will have a lasting impact on the way that the region tends to align itself in the international system.